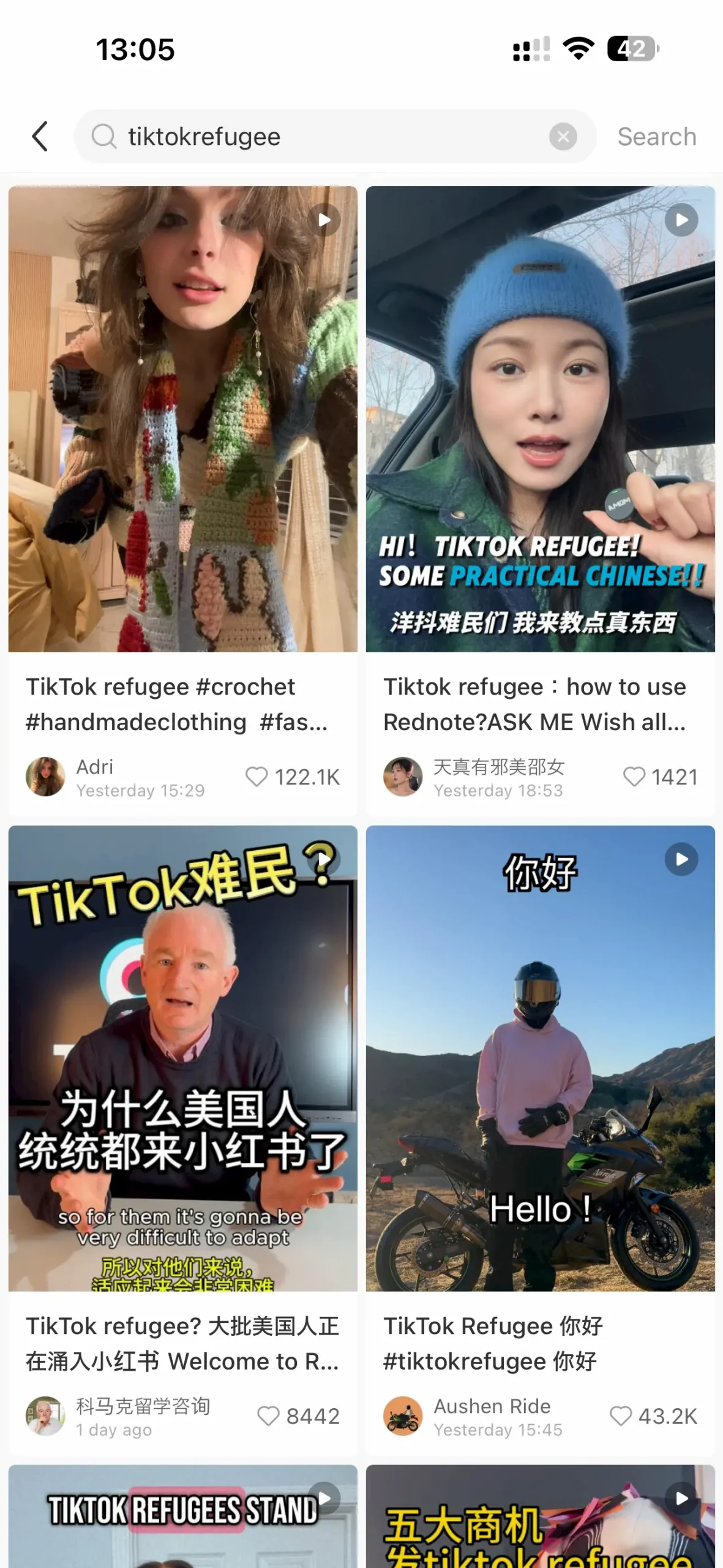

As TikTok faces increasing regulatory pressure in the U.S., a wave of displaced content creators and users, dubbed “TikTok refugees”, have begun migrating to Xiaohongshu (RED)—China’s influential lifestyle and e-commerce platform.

This sudden influx has propelled Xiaohongshu to the top of the U.S. App Store, overtaking other alternatives like Lemon8 and Instagram Reels. But this migration raises critical questions:

- Can Xiaohongshu sustain and engage this international audience?

- How does it compare to Twitter X, Instagram, and Facebook in 2025?

- Is this shift a temporary trend or the beginning of a new global social media paradigm?

This report explores why Xiaohongshu became the preferred alternative to TikTok, the implications for content creators, and how global social media platforms are responding to the shift.

1. TikTok’s Uncertain Future Drives Users to Xiaohongshu

(1) The TikTok Ban: Triggering a Digital Migration

On January 19, 2025, the U.S. government’s restrictions on TikTok were set to take effect.

- Despite legal appeals from ByteDance, the ruling forced TikTok to shut down operations in the U.S. unless sold to a domestic company.

- Rather than comply, ByteDance refused to sell TikTok, triggering a mass exodus of users looking for a new platform.

(2) The Rise of Xiaohongshu in the U.S.

With TikTok no longer available, users sought alternatives. The top contenders included:

- Xiaohongshu (RED)

- ByteDance’s own Lemon8

- Instagram Reels

- Snapchat Spotlight

- YouTube Shorts

However, Xiaohongshu (RED) unexpectedly emerged as the top choice, reaching #1 in the U.S. App Storeovernight

Its appeal lay in:

- A familiar recommendation algorithm similar to TikTok.

- Aesthetic and community-driven content, unlike the ad-heavy Reels.

- Minimal censorship compared to Instagram.

- A surge of influencers and content creators actively promoting Xiaohongshu as the “new TikTok.”

2. Why Are TikTok Creators Choosing Xiaohongshu?

(1) Xiaohongshu’s Algorithm Mirrors TikTok’s Strengths

- Unlike Instagram Reels, which prioritizes existing follower networks, Xiaohongshu uses an AI-driven recommendation system.

- Like TikTok, content discovery is not limited by follower count, making it easier for new creators to gain traction.

(2) Community-Driven Content Over Corporate Ads

- Instagram and Facebook have become ad-heavy with decreasing organic reach for small creators.

- Xiaohongshu, despite its e-commerce integration, still feels more “organic” and creator-friendly.

“I just posted my first video, and it’s already getting thousands of views. This feels like early TikTok again!” — A new Xiaohongshu user from the U.S.

(3) A Cultural Shift: The Appeal of a Chinese Social Media App

- Xiaohongshu offers a unique global mix of Eastern and Western content, creating an intriguing new digital space.

- Chinese netizens are welcoming “TikTok refugees”, with many engaging in language exchange and cultural discussions.

- Unlike other Western apps, Xiaohongshu is not seen as part of “Big Tech” censorship.

3. The Challenge: Can Xiaohongshu Sustain This Global Audience?

Despite its meteoric rise, Xiaohongshu faces significant obstacles in retaining international users:

(1) Language Barriers & Localization

- Xiaohongshu lacks a built-in translation feature, making content navigation difficult for non-Chinese users.

- Without localized content moderation, Western users may struggle to understand community guidelines and platform policies.

(2) The U.S. Government Could Target Xiaohongshu Next

- If the U.S. government banned TikTok due to “national security risks,” it could turn its attention to Xiaohongshu, citing similar concerns.

- Some users are already anticipating a potential ban, treating Xiaohongshu as a temporary refuge rather than a permanent home.

(3) Can Xiaohongshu Handle the Sudden Traffic Surge?

- Content moderation, server infrastructure, and engagement tools are not optimized for Western audiences.

- The company’s ability to quickly implement global-friendly features will determine its long-term success.

4. Social Media in 2025: How Are Twitter X, Instagram, and Facebook Responding?

(1) Twitter X: Struggling to Compete with Video Content

- Elon Musk’s push for video content has not successfully rivaled TikTok.

- Twitter X’s AI-generated content has faced backlash, with users preferring real human-driven content.

- Creators migrating from TikTok find Twitter X’s video monetization less attractive.

(2) Instagram & Facebook: Over-Reliance on Ads

- Instagram Reels lacks the organic engagement of TikTok or Xiaohongshu.

- Facebook’s declining youth engagement continues, with younger users preferring decentralized platforms.

- Many TikTok creators refuse to migrate to Instagram, citing lack of algorithmic fairness and heavy censorship.

(3) YouTube Shorts: The Only Strong Alternative?

- YouTube Shorts is the closest competitor to TikTok, offering monetization opportunities through the YouTube Partner Program.

- However, it lacks the spontaneous virality that TikTok and Xiaohongshu offer.

“YouTube Shorts is great for polished content, but it’s not as fun and interactive as TikTok was.” — Former TikTok influencer.

5. User growth trend comparison about Twitter X, TikTok, Xiaohongshu, Instagram and Facebook

Here is the table for glance.

(1)Social Media Platform User Growth Comparison (2023)

| Platform | Monthly Active Users (MAUs) in 2023 (millions) |

|---|---|

| TikTok | 1500 |

| Xiaohongshu | 312 |

| 237.8 | |

| 2963 |

(2)TikTok:

- Global Monthly Active Users (MAUs): TikTok reached approximately 1.5 billion MAUs in 2023 and is projected to attain 1.8 billion by the end of 2024. Business of Apps

- U.S. Monthly Active Users: In March 2023, TikTok reported 150 million MAUs in the United States, marking a 50% increase from 100 million in August 2020. Statista

(3)Xiaohongshu (Little Red Book):

- Monthly Active Users: Xiaohongshu’s user base reached 312 million MAUs in 2023, representing a 20% increase from the previous year, making it the fastest-growing large social media platform in China during that period. Net Influencer

(4)Twitter:

- Monetizable Daily Active Users (mDAUs): As of Q2 2022, Twitter reported 237.8 million mDAUs, an increase from 206 million in Q4 2020. However, specific data for 2023 is not readily available.

(5)Facebook:

- Global Monthly Active Users: Facebook reported 2.963 billion MAUs as of Q3 2023, showing a steady increase from 2.8 billion in Q4 2020.

6. What’s Next? The Future of Xiaohongshu and Global Social Media

(1) Xiaohongshu’s Potential to Become the Next TikTok

If Xiaohongshu successfully:

- Implements language translation tools,

- Enhances international user experience,

- Builds monetization options for Western creators,

it could emerge as a true TikTok replacement.

(2) Will the U.S. Government Ban Xiaohongshu Next?

- If Xiaohongshu’s influence continues to grow, it may face scrutiny like TikTok did.

- However, it currently flies under the radar due to its e-commerce branding.

(3) The Rise of a Decentralized Social Media Movement

- Users may shift towards independent, decentralized platforms (e.g., Bluesky, Nostr).

- The era of monolithic social media platforms may be ending, with users preferring community-driven networks.

7. Conclusion: Is Xiaohongshu the Future of Social Media?

Xiaohongshu’s unexpected global rise signals a potential shift in social media trends:

✅ Algorithm-driven content over follower-based feeds

✅ Community-first engagement over ad-heavy platforms

✅ Cultural diversity creating new global conversations

However, its long-term survival depends on localization, monetization, and government regulations.

Whether it remains a TikTok refugee camp or evolves into a global powerhouse will be determined in 2025. 🚀